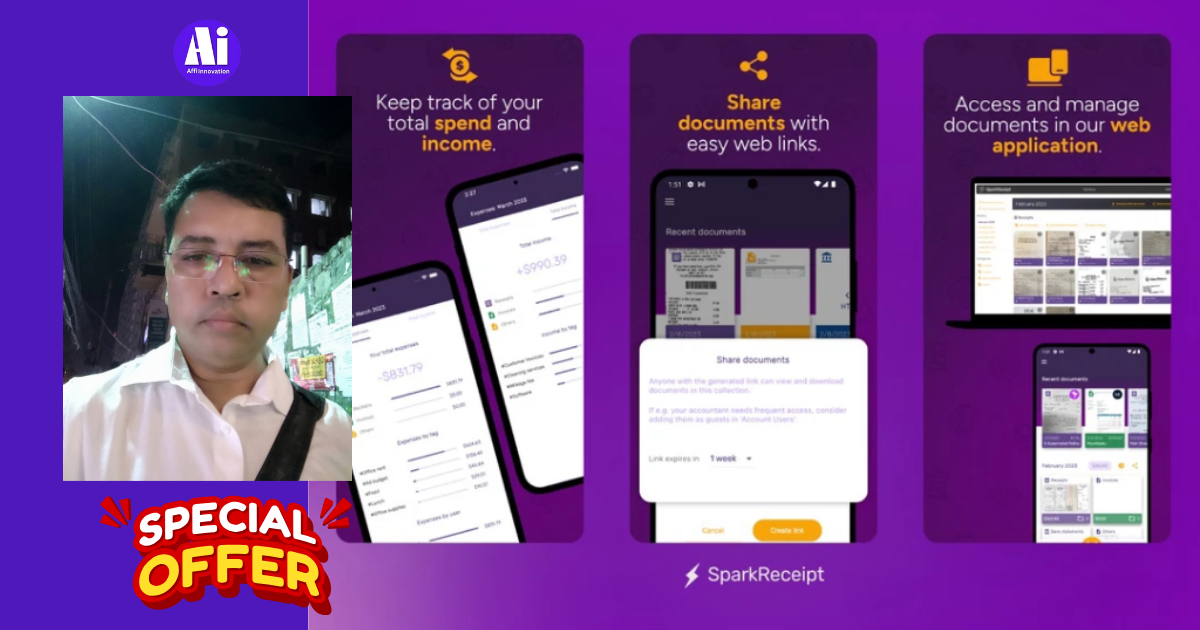

SparkReceipt: The Ultimate Breakthrough Tool for Expense Tracking & Compliance 2024

Discover how SparkReceipt’s AI-powered receipt scanner simplifies expense tracking and document management for freelancers and small businesses. Save time and stay organized!

In today’s fast-paced, tech-driven world, freelancers and small business owners juggle numerous responsibilities daily. Among these tasks, managing finances is often one of the most challenging and time-consuming. For many, tracking expenses, managing receipts, and ensuring tax compliance can become overwhelming. This is where SparkReceipt, an AI-powered receipt scanner, document manager, and expense tracker, steps in to simplify and streamline financial tasks.

»»»»Get lifetime access today. Click Here««««

What is SparkReceipt?

SparkReceipt is an advanced AI-powered tool designed to help freelancers, contractors, and small business owners efficiently track and manage expenses. By using AI to digitize, categorize, and organize receipts, SparkReceipt transforms complex financial processes into easy, manageable steps. Users can effortlessly snap photos of receipts, upload documents, and let the tool handle the tedious parts, like data entry, categorization, and storage.

Here’s a closer look at how SparkReceipt can benefit small businesses and freelancers by automating their expense tracking and document management.

Key Features of SparkReceipt for Freelancers and Small Businesses

- AI-Powered Receipt Scanning Spark-Receipt uses AI technology to scan receipts, extracting essential details such as date, vendor, and total amount. This feature eliminates the need to manually input data, saving users valuable time and minimizing the chances of errors. The AI learns over time, improving its accuracy in extracting information, which makes it a perfect tool for freelancers and small business owners who have to process dozens of receipts every month.

- Real-Time Expense Tracking Expense tracking can be a daunting task, especially when expenses occur frequently. With Spark-Receipt, every scanned receipt is instantly categorized, allowing users to view their expenses in real time. This feature makes it easy to monitor cash flow, budget for upcoming projects, and make informed financial decisions without waiting until the end of the month to see a full report.

- Digital Document Management SparkReceipt isn’t just limited to receipts; it also allows users to manage invoices, contracts, and other important business documents. The platform organizes everything digitally, meaning you can access important files anytime, from anywhere. With secure cloud storage, freelancers and small business owners can rely on SparkReceipt to store all their financial records safely, without the need to worry about lost paper receipts or misplaced files.

- Categorization and Labeling Proper categorization of expenses is crucial for financial reporting and tax preparation. Spark-Receipt makes it easy to categorize expenses by business type, such as travel, meals, office supplies, and more. Additionally, users can create custom labels to further organize their documents. This feature simplifies tax preparation, helping users easily identify deductible expenses and reducing the risk of audit issues.

- Expense Reports and Insights With Spark-Receipt, users can generate customized expense reports that offer insights into their spending patterns. These reports can be invaluable for small business owners who want to make better financial decisions or freelancers looking to identify areas for saving. The reports can also be shared with accountants, making tax season less stressful and more efficient.

- Seamless Integration with Accounting Software SparkReceipt integrates with popular accounting platforms, such as QuickBooks and Xero, making it easier to maintain up-to-date financial records. This feature allows freelancers and small businesses to keep all their financial data in one place, eliminating double entries and reducing errors that can arise from managing multiple systems.

Benefits of Using SparkReceipt for Freelancers and Small Business Owners

- Saves Time and Reduces Manual Work Freelancers and small business owners can spend hours each month entering receipts, organizing expenses, and preparing for taxes. SparkReceipt’s AI-driven features drastically reduce the time spent on these tasks, freeing up time to focus on more critical areas of the business, like serving clients or growing the brand.

- Improves Accuracy and Reduces Errors Manual data entry is prone to errors, and even small mistakes can lead to significant financial issues, especially during tax season. SparkReceipt’s AI capabilities minimize the risk of errors by automating data entry and ensuring that receipts are categorized accurately. This improved accuracy can prevent costly mistakes and help small businesses stay compliant with tax regulations.

- Enhances Organization and Accessibility: With SparkReceipt, users can store all their documents in one place, organized by categories and labels. This makes it easy to access financial records when needed, whether for budgeting, reporting, or audits. Plus, having documents stored in the cloud means they’re accessible from any device, making remote work and mobile management simple and efficient.

- Facilitates Budgeting and Financial Planning By providing real-time insights and detailed reports, SparkReceipt enables small business owners and freelancers to understand their spending patterns better. This data can be used to make informed budgeting decisions, plan for future expenses, and even set financial goals. Knowing where your money is going each month allows you to allocate resources more effectively, helping the business grow sustainably.

- Supports Tax Preparation and Compliance Tax season can be stressful, especially for freelancers and small businesses. SparkReceipt simplifies tax preparation by organizing receipts, categorizing expenses, and generating reports that are IRS-ready. This ensures that users are well-prepared for tax filings, making it easier to identify deductions, avoid audits, and meet compliance requirements.

How SparkReceipt Stands Out in the Market

While several tools offer receipt scanning and expense management, SparkReceipt’s AI capabilities make it particularly appealing for freelancers and small businesses. The platform’s ability to learn over time, adapt to users’ needs, and streamline complex tasks sets it apart. Unlike other apps that simply store receipts, SparkReceipt functions as a comprehensive financial management solution, providing real-time tracking, categorization, and actionable insights.

Practical Use Cases of SparkReceipt

- Freelancers in Creative Fields: For freelance designers, writers, or photographers, project expenses can pile up quickly, making tax deductions challenging to track. SparkReceipt helps by categorizing every receipt instantly, so when tax season arrives, the freelancer can easily locate deductible expenses, such as software subscriptions, travel, or client meetings.

- Small Business Owners in Retail: Small business owners in retail often purchase products or supplies from multiple vendors. SparkReceipt not only organizes these receipts but also categorizes them by supplier, helping users keep track of their spending with each vendor. This data can inform future purchasing decisions and budgeting strategies.

- Consultants and Contractors: Consultants and contractors frequently work on different projects with various expense categories. SparkReceipt makes it simple to label and categorize receipts based on projects, which helps in billing clients accurately and provides a clear picture of project-specific expenses.

Getting Started with SparkReceipt

Starting with SparkReceipt is simple. The app is available on both iOS and Android, making it accessible to users on the go. Once installed, users can snap a photo of their receipts, and the AI-powered scanner does the rest. SparkReceipt’s intuitive interface is designed for ease of use, even for those new to digital financial management.

Conclusion

For freelancers and small business owners, financial management can be one of the most challenging aspects of running a business. With SparkReceipt, users can transform this complex process into a streamlined, efficient system, freeing up time to focus on growing their business. The AI-powered features of SparkReceipt provide real-time tracking, accurate categorization, and secure document storage, making it a valuable tool for any professional looking to simplify their financial workflow.

If you’re a freelancer or a small business owner looking to take control of your finances, SparkReceipt could be the game-changer you’ve been searching for. Embrace the power of AI-driven financial management, and let SparkReceipt help you stay organized, accurate, and compliant every step of the way.

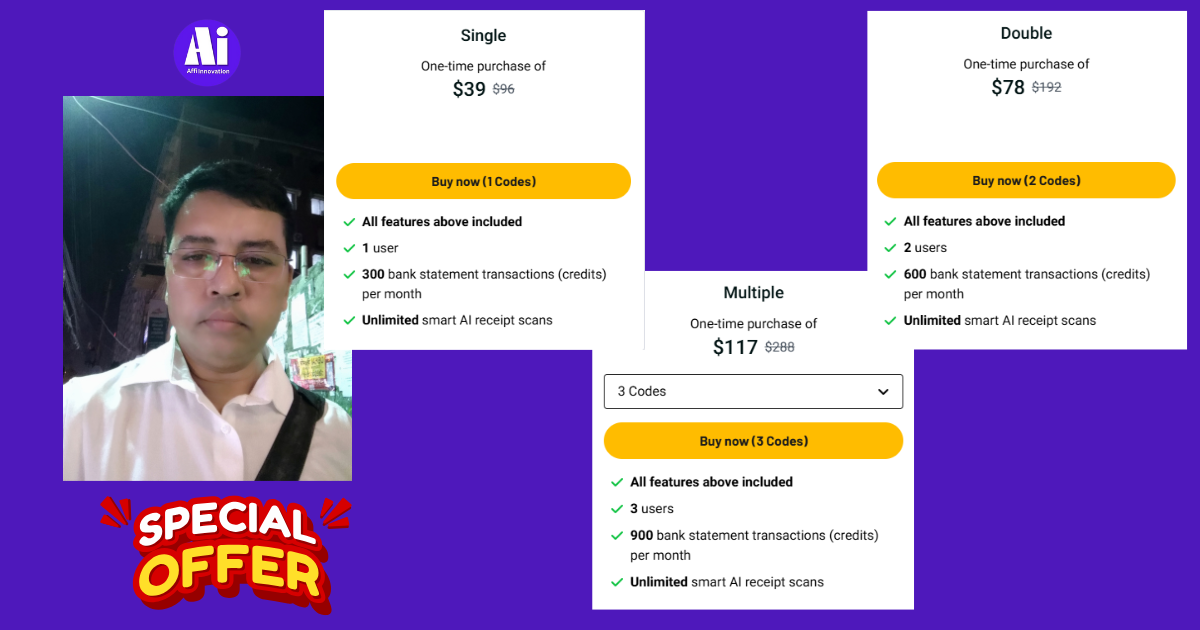

Features & Plans

Terms and conditions of the deal

- Access to SparkReceipt for life

- Every Pro Plan update in the future

- The agreement will be mapped to the new plan name with any related adjustments if the plan name changes.

- You have sixty days from the date of purchase to use your code or codes.

- Stack an infinite number of codes

- To expand their feature limits, former AppSumo users who bought SparkReceipt can purchase additional codes.

- Any new features and feature limitations will be grandfathered in for previous AppSumo users.

- One user and 300 monthly credits are unlocked with each extra code.

60-day money-back guarantee with an award badge. To make sure it’s right for you, give it a try for two months!

- Features that are part of every plan

- Email receipts should be forwarded and scanned.

- Ask your accountant to work with you.

- Create expense reports in CSV, Excel, or PDF format.

- Keep personal information separate from